Solar Tax Credit in 2024: What Is It & How It Works?

The federal tax credit is a great incentive for the US landowners from their government, as a reward for installing solar systems. The tax credits pay part of the unsettled federal income tax that you owe the government. The role of the Investment Tax Credit (ITC) tax is to encourage citizens across the US to shift to green and renewable energy. In this article, we shall educate you about the federal solar panel tax, how to qualify, and how to claim it.

What is a Solar Tax Credit?

The ITC also known as the Residential Clean Energy Credit is a solar incentive in the form of credit taxes. The ITC is an initiative of the US government to encourage more of its citizens to shift to renewable and green energy such as solar and wind energy for a sustainable future for the country.

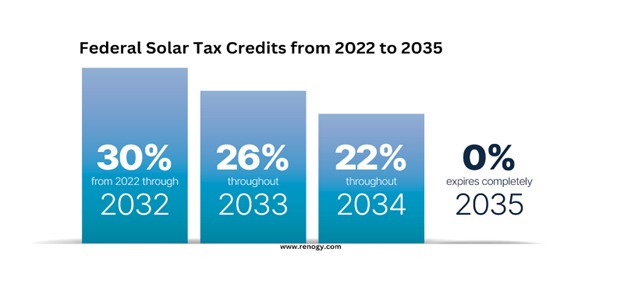

The credit taxes on solar reduces a significant amount on the total costs of purchasing and installing solar, inclusive of labor. The current federal solar tax credits stand at 30% beginning in 2022 to 2032.

How Does the Solar Tax Credit Work?

The federal solar panel tax credit is available to the USA homeowners for installing solar panels and the solar system. Please note that you will not receive this incentive as a handout. The credit goes into paying your federal taxes owed to the government. However, if based on your costs of installation you are eligible for more solar panel federal tax credit than your outstanding federal income taxes, you can roll over the extra unused credits to subsequent tax years.

For example: The total sum you have spent to install solar panels in your home is $22,000. You claim and successfully receive a 30% solar panel tax credit from the US government. The 30% of $22,000 is $6,600. This means your tax credit is $6,600. Therefore, if you owe the US government a federal tax liability of $8,000 and you claim the tax credit of $6,600, your new outstanding federal tax liability is $1,400.

How and When to Claim the Solar Panel Tax Credit?

First, ensure you are qualified to successfully claim the solar panel tax credits. To claim the federal solar panel tax credit successfully, ensure you are meeting the following requirements:

- You must install the solar panels on your USA home. Federal tax credits do not cover the homes or properties outside the country.

- The project must be within the specified timelines between 2022 and 2032. The 30% tax credits do not apply to taxes outside this period.

- Leased solar panels do not qualify for incentives and tax credits. The solar panels must be in your freehold possession to claim the Federal tax credit for solar panels.

- Solar projects that qualify for the incentives and tax credits are costs of buying solar equipment such as solar panels, generators, and wires. Others include solar water heaters, solar home cooling, and heating systems. Also, the solar tax credits cover the labor involved, such as surveying and installation.

Once you have ascertained your eligibility, you can proceed to claim the solar tax credits. Getting a PTO (permission to operate) before requesting the solar tax credit. Once you have installed the solar system, claim the tax credits within that year.

Example: Assuming you installed your solar system in 2022. You should claim the solar panel tax credits when filing the 2023 taxes, between January to April.

Follow this process to claim your solar panel tax credits in 2024 successfully.

- Fill out the IRS Form 5695. Download it on the IRS website.

- When filling out the form, select “qualified solar electric property costs”. Do the calculations as instructed to determine the costs of the system installation.

- Fill out the final sum on the required line. Check if you have any restrictions on your tax liability. Utilize the IRS Residential Energy Efficient Property Credit Limit Worksheet to verify the information. Do the calculations.

- Remember to fill in the total figure on Form 1040.

You should hire a tax expert if you do not understand how the tax system works.

How to Combine Solar Tax Credit and Other Incentives

In addition to the federal solar tax credit, most utility companies, municipals, state governments, and organizations offer incentives, rebates, and other discount programs to homeowners who have installed solar systems. Check the qualifications for these other incentives and rebates and claim them to enable you to save more on solar system installations on your property.

Some of the common rebates and incentives include:

1. Utility Rebates

The utility rebates are issued by utility companies. If you benefit from the utility rebates, you will not benefit from the federal solar tax. The rebates are subtracted from the total costs of solar products. The balance from this amount is what you claim for tax credits.

Example:

Assume the solar panel's installation costs you $40,000 and you receive an incentive worth $10,000. You should calculate the tax credit by subtracting the utility rebate. Therefore, you will calculate the value of the federal solar tax credit from the remaining amount which is $30,000.

2. State Solar Tax Credits

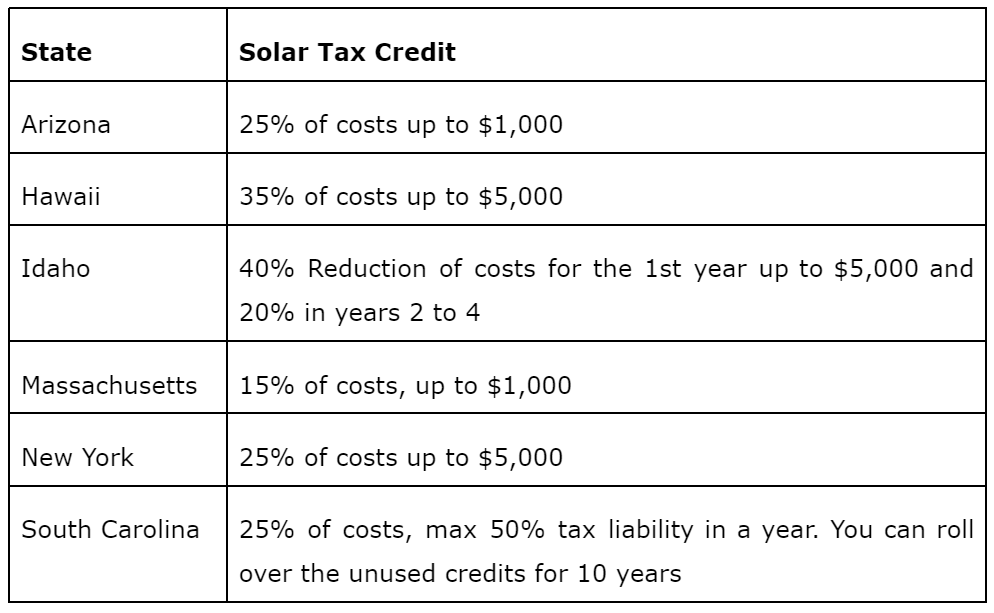

Some states have solar tax credits, similar to the federal tax credit. The state credit is worth a certain amount of the solar system installation costs. Like the federal tax credits, the specific state solar tax credits reduce your state tax liability. Also, it does not impact the value of the federal tax credit. However, if you claim the state solar tax credit, it will affect your federal taxable income.

States where the state solar tax credits are available include:

3. Performance-Based Incentives

Utility companies give qualified homeowners performance-based incentives. The amount you receive depends on the amount of solar energy your system generates.

4. Net Metering

Net metering is a system provided by grid utility companies to benefit homeowners and businesses. It favors people who have installed solar systems in their homes and generate more energy than they can consume.

It operates by allowing you to give the surplus solar energy to the grid. When you send the excess solar energy back to the grid, your electricity meter starts counting backwards, based on the credits you send to the grid. This means part of your electricity bills are covered by the solar energy your system generates.

The billing method helps to reduce your electricity bills. Most states across the US have net metering.

States with the Best Solar Tax Credit in 2024

Some of the states with impressive solar incentives include:

1. Arizona Solar Incentives

The Arizona State is nicknamed the ‘Sunshine State’. Common solar incentives in Arizona are:

- Arizona State Residential Solar Income Tax Credit

- Solar property tax exemption

- Solar sales tax exemption

- Net billing

2. California Solar Incentives

California receives ample sunshine throughout the year. Additionally, due to high energy costs, people have massively started shifting to solar energy. Some of the solar panel tax credits California and incentives include:

- Self-Generation Incentive Program (SGIP)

- Property Assessed Clean Energy (PACE)

- Solar rebate

- Solar stipend

3. Colorado Solar Incentives

The Colorado state funds the local solar projects through local solar incentives, thanks to the Clean Energy Bill, of 2023. Other incentives available in Colorado are:

- Solar sales tax exemption

- Solar property tax exemption

- Weatherization Assistance Program (WAP)

- Energy Smart Colorado Renewable Energy Rebate

- City of Boulder’s Solar Rebate Ordinance

4. Connecticut Solar Rebates and Incentives

Connecticut is one of the states in the USA with the highest electricity bills cumulatively. Solar incentives, reliefs, and rebates can help significantly lower the costs of electricity in Connecticut. Solar incentives available in Connecticut are:

- The Solar sales tax exemption

- Solar property tax exemption

- The Residential Energy Solutions program

5. Florida Solar Incentives

Florida is home to many utility companies. With a sunny climate all year it is one of the best states to invest in solar energy. Some of the rebates, state tax credits, and incentives are:

- The Property tax exemption

- Sales tax exemption

- Property Assessed Clean Energy (PACE)

- Net metering

Invest in Solar Energy with Renogy Solar Panels

To qualify for the federal solar panel tax credits and incentives, you must purchase solar panels and other solar equipment that are necessary to build a solar system. When shopping for solar panels, ensure they are made with high-quality and durable materials. One of the reputable solar brands with excellent quality and durable solar panels and other equipment is Renogy.

Here are some of the high-quality solar panels you can purchase from Renogy.

550 Watt Monocrystalline Solar Panel

The 550W Monocrystalline solar panel is specially designed for residential installation, commercial applications, and for utility-scale systems. The 500-watt monocrystalline solar panel features high-efficiency PERC cells and Half-cells with 10-Busbar technologies for improved power output and electrical performance.

400W Lightweight Portable Solar Suitcase

Renogy 400W portable solar panel features an inbuilt suitcase. The high-wattage and easy-to-transport solar panel is suitable for outdoor living and home use in case of emergency power outages. It is easy to set up, thanks to its robust kickstands.

Additionally, it features IP67 protection and an ETFE coating. It comes with IP68 solar connectors for easy set-up. The compatibility and portability nature of these solar panels allows you to easily use them outdoors.

Conclusion

The federal solar panel tax credits promote the affordability of solar panels for a more sustainable and greener future for the country. Additionally, claim other rebates, incentives, and solar benefits from other organizations such as local state governments, non-governmental organizations, and utility companies. Follow the above-discussed process to ensure you are eligible to claim these incentives.

FAQ

1. Can I still profit from the federal solar tax credit, even if I have cleared my income tax?

You cannot receive the solar tax credit in cash. You can inform the tax services about this and apply to utilize your credit in the later years.

2. Can I successfully claim all the available incentives and rebates?

Yes. You can claim all the available incentives and rebates in your state.

3. What is included in the federal solar tax credit cover?

The federal solar tax credit covers:

- Solar panels and PV cells

- Solar water heaters

- Contractor labor costs such as initial installation costs and site preparation

- Permit fees

- Developer fees

- Inspection fees

4. How many times can I claim the solar panels tax credit in the US?

The current tax laws allow the homeowner to claim the solar installation credit tax once. You can only claim multiple tax credits if you own multiple properties with installed solar panels.