Ohio Solar Panel Installations: 2024 Pricing & Savings

Ohio has experienced positive growth in solar energy installations over the last few years. The numerous and highly generous incentives, environmental benefits, and profitability have influenced more people to embrace solar energy in Ohio. Are you aiming at reducing your carbon footprint and gaining energy independence? We are here to give you broad insights about the costs of solar panels in Ohio, and how you can save a lot by claiming various incentives.

How Much Do Solar Panels Cost in Ohio?

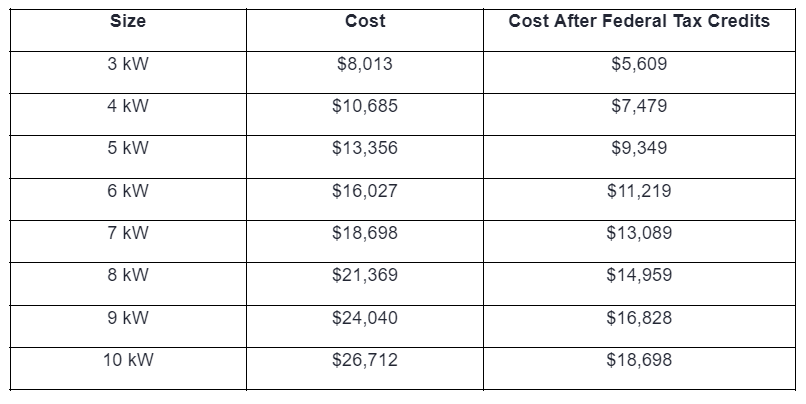

The average cost of solar panels in Ohio in July 2024 is $2.67/W including the installation or labor costs. If you install a 5 kW solar panel, you are going to spend approximately $13,356 without the incentives or rebate. However, the actual expenses can range between $11,000 to $15,500. If you claim the incentives and rebates in Ohio, this cost can go as low as around $8,000.

Factors Affecting the Cost of Solar Panels in Ohio

Various factors impact the costs of solar systems in Ohio. Some of these factors include:

1. Type of the Panel

Solar panels are categorized into three: Polycrystalline, monocrystalline, and thin-film solar panels. Monocrystalline panel types are the most expensive because they are highly resilient and energy-efficient. Polycrystalline is less efficient and, thus less expensive. The thin-film panels are the least expensive because they are not durable and efficient compared to other types of panels.

2. Number of Panels

The size of the solar system affects the total cost of the solar panels. A bigger solar system requires a higher quantity of solar panels. More solar panels mean, a higher price per wattage.

3. Solar Panel Brand

There are various solar panels brands across the US and Ohio. Various brands have their specific prices. Get quotations from various brands for comparison.

4. Labor Expenses

The labor expenses of installing the solar panels will increase the overall prices of the panels. Some companies will give you the costs of the panels, inclusive of the labor costs. Always request for a breakdown of the pricing.

5. Type of Financing

You can finance your solar panels through a loan, lease, power purchase agreement, or cash purchase. The type of funding you choose will influence the total costs of the solar panels. For instance, you will not incur anything if you install leased solar panels. However, the long-term will be much lower compared to purchasing solar panels.

6. Other Solar Components

Solar panels require other components such as batteries, inverters, and generators for an effectively operational solar system.

But some of the components such as batteries or generators are not crucial, but necessary, especially during emergency blackouts. The total costs of these components will determine the amount you will pay in the end.

7. Permits and Interconnecting Costs

In Ohio, various municipalities require you to obtain all the necessary permits and pay the required fees. These costs add to the total cost of solar panels.

Ohio Solar Incentives In 2024

Solar panel investment is a gateway that allows you to tap into the free and clean energy of solar power. However, the high solar installation costs are intimidating for most people.

Incentives such as the federal tax incentive, rebates, and Ohio tax credits are designed to provide relief to homeowners across Ohio. They make acquiring solar panels affordable thus helping more people achieve sustainability, reduce their carbon footprint, and realize energy independence goals.

Here’s a guide and breakdown of the Ohio benefits and incentives plus other necessary information to enable you to benefit from these incentives.

1. The Federal Solar Tax Credit

All the US states, including Ohio, can claim the federal solar tax. The ITC tax enable homeowners to save 30% of their solar panels installation costs. You must own the solar system to successfully claim the ITC. If you combine this with other available incentives in Ohio state, you can significantly save money on all costs of solar system installation.

2. Solar Renewable Energy Credits (SRECS)

The SRECs program allows you an additional income for generating electricity. With this incentive, you earn one Renewable Energy credit for every 1,000 kWh (megawatt-hour MWh) your solar system produces. You can directly sell the SRECS in the SREC market for cash.

The price fluctuates due to the market and utility conditions. On average, if your system generates one SREC per month, you can earn up to $100 a year.

3. Qualified Energy Project Tax Exemption

The solar sale tax exemption benefits solar system projects that qualify based on their criteria. The average sales tax in Ohio is 5.7%. The exemption targets personal properties with solar panels generating electricity with certified “qualified energy projects”.

However, for the eligibility of these tax exemptions, the projects must observe some conditions such as early application of submissions, getting necessary approvals, and meeting construction timelines. After the certification, the projects are exempted from taxation for a certain number of years.

4. Ohio Property-Assessed Clean Energy Financing (PACE)

The PACE program works with the local governments to link homeowners with the permitted PACE contractors and providers. The program provides a fixed rate on PACE loans for a fixed term of 15 to 25 years. Residential and commercial property owners can get up to 100% of the costs from this program.

5. Net Metering

Ohio’s net metering program allows homeowners or businesses that generate surplus solar energy to sell it to the grid system. In exchange, the homeowner receives credits that cover your electricity bills depending on the amount remitted. The solar buyback program allows homeowners to use electricity while paying minimal bills.

Should I Buy or Lease Solar Panels in Ohio?

To lease or to buy? Before settling on either option, you must think critically about your finances, your short-term and long-term goals, as well as future home goals.

The average duration for solar panel leases is 20 to 25 years. If you choose to lease, you must be willing to undertake a long-term financial commitment. If you decide to buy, you must be prepared to pay a hefty initial installation investment. So, should you lease or buy solar panels in Ohio? Here’s a breakdown.

Leasing Solar Panels Ohio

Leasing solar panels works similarly to leasing a car. You commit to paying a fixed monthly charge to keep utilizing solar power. Leasing solar panels allows you to make long-term energy savings on electricity bills. Advantages of leasing solar panels in Ohio include:

- Zero costs on installation and interconnection

- No maintenance and repair costs

- Long-term savings on electricity bills

The downsides of leasing solar panels are:

- Long-term solar panel leases complicate the home-selling process

- No benefits from the rebates and tax incentives

- Minimal lifetime savings compared to owning solar panels

Buying Solar Panels in Ohio

Do not lease solar panels if you have the financial muscle to purchase them. Although the cost of purchasing solar panels is high, it potentially gives you higher life savings compared to leasing.

The benefits of buying solar panels are:

- You receive benefits like federal tax credits, Ohio solar tax credits, rebates, and other incentives.

- Solar panels elevate the value of your home/property

- You potentially make more long-term savings compared to leasing

Conclusion

Solar panels will enable you to save thousands of your money on energy bills while improving the worth of your home. Whether you are leasing or buying, you are guaranteed to save money by reducing your reliance on electricity.

As discussed above, the cost of solar panels in Ohio varies depending on several factors. Although the solar panel purchase prices are high, incentives and programs such as tax credits, SRECs, and net metering help greatly lower the money you incur on purchasing and installing solar panels.

FAQ

1. How can I get free solar panels in Ohio?

There are no programs offering absolutely free solar panels in Ohio. You can only get almost free solar panels in Ohio, through leasing or the PPA contracts. However, with these programs, the utility company installs the panels on your roof. You are required to pay a monthly rent for the panels. Alternatively, you can pay the equivalent of what the solar panels generate for your household.

2. How much can I possibly save with solar panels in Ohio?

In 2024, the average electricity bill for Ohio residents is approximately $137.57, with the solar panel lifespan being 25-30 years. You can regain all solar system installation costs within 10 to 11 years. You can potentially have thousands for the remaining years. Also, claiming the rebates and incentives allows you to save even more.